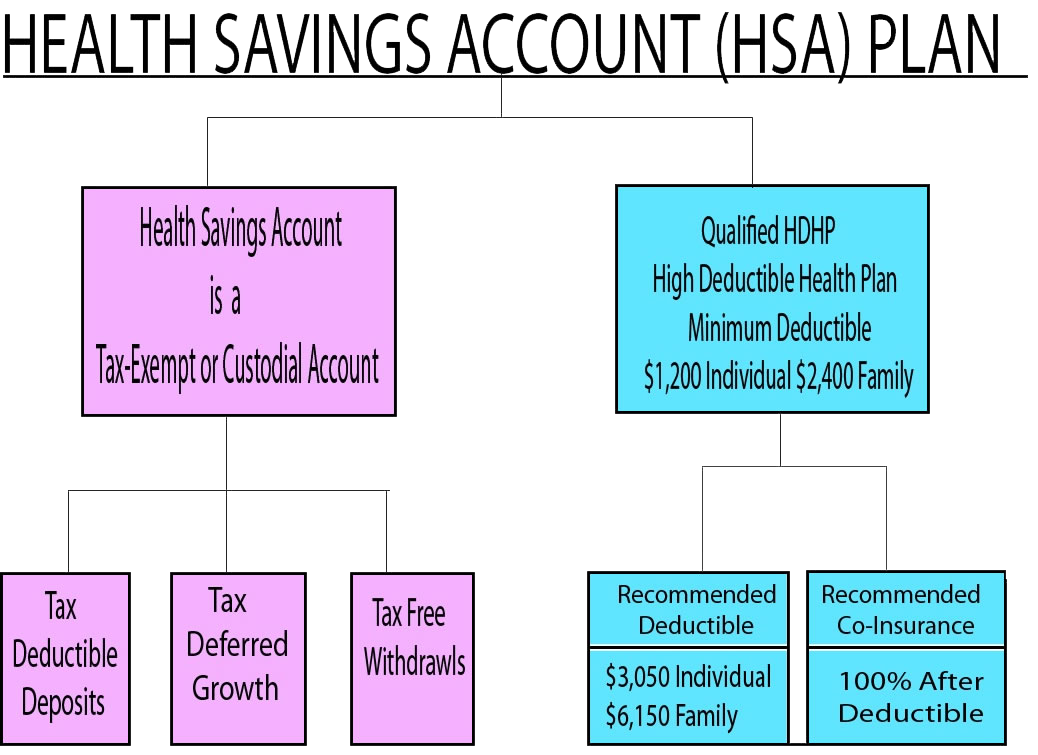

Health Savings Accounts (HSAs) are the product of the Medicare Prescription Drug, Improvement and Modernization act signed into law December 2003, by President Bush. HSAs are similar to IRAs in that the contributions are deductible to the contributor (employer or employee) and generate tax-free earnings. Employers or family members may make contributions to the HSA on behalf of the qualified individual. Similar to the IRA, the HSA is individually owned and is completely portable if the employee changes jobs or leaves the workforce. The big difference is that withdrawals are tax-free if used to cover covered medical expenses. However, HSAs can not stand alone. To be eligible for a HSA the individual must be covered by a High Deductible Health Plan (HDHP). Any individual is eligible to contribute to an HSA if they have a qualified health plan and are not covered under any other health plan (including Medicare). An HDHP is a plan with a $1,200 minimum deductible for an individual and $2,400 for family. In 2012, the maximum annual contributions to HSAs is $3,100 for individuals and $6,250 for family coverage. Each year, the dollar limits will be adjusted for inflation. Individuals 55 and older that are covered by an HDHP can make additional "catch up" contributions. In 2012, the “catch up” contribution is $1,000. Contributions must stop once the individual is eligible for Medicare. For the amount of distribution to be tax free it must be for qualified medical expenses or eligible insurance premiums. If the amount distributed is used for anything other than qualified medical expenses, the disbursement will be taxed and subject to a penalty. Contributions must stop once the individual is eligible for Medicare.

|